Following up on last week’s post, let’s assume we want to add the constraint that the stock position we hold initially q_0 = Q be fully liquidated by time T: q_T = 0. Here we’ll assume no permanent market impact and a general penalization term in the value function, which will allow us to present a general method which may not be widely known (even though it is standard in the mathematical study of Hamilton-Jacobi equations). Specifically, our price, inventory, and cash processes (s_t, q_t, x_t respectively) satisfy

and the value function is defined by

for a general convex function f (which was quadratic last week). The value function u is readily seen to satisfy

Choosing the auxiliary function h

leads to the following HJB equation for h:

This easily translates into

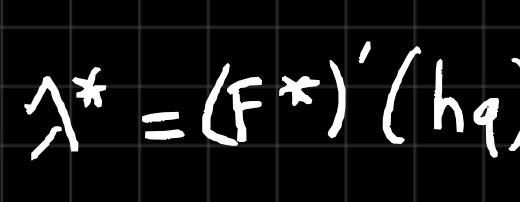

where F* denotes the Legendre-Fenchel transform of F, and the optimal policy — optimal speed of trading λ* — is the value of λ at which the supremum in (5) is reached, namely

Problem (6) along with the boundary condition in (5) admits an explicit solution called the Lax-Oleinik formula which, in our case, reads:

since F**=F, f (and therefore F) being convex. From (8) we derive

and therefore

since the derivatives of F and F* are inverse of each other. Now, by (1) λ* = -dq/dt, and therefore, solving (10), the optimal liquidation strategy in terms of our stock inventory q(t) is

which corresponds to a constant speed of selling λ* = Q/T.

From this analysis we can see why (11) is optimal in a number of situations and how the Lax-Oleinik formula can help us understand this type of problems.

Quantitatively Yours,