The Sweet Spot of BBB’s

Investing in the lower tier of Investment-Grade corporate bonds (R. Benhenni and J. Busca)

In today’s complex financial landscape, investors constantly seek ways to maximize returns while managing risk. One strategy gaining traction, particularly in the fixed-income space, is investing in BBB-rated corporate bonds - the lowest tier of Investment-Grade securities. While these bonds offer attractive yields, their increased credit risk makes diversification within a BBB-rated corporate bond portfolio critical to achieving a stable and resilient investment outcome.

BBB-rated corporate bonds are issued by companies deemed to have adequate credit quality, but they sit just above speculative-grade (High-Yield) status. They represent a sweet spot for many investors offering higher yields than AAA to A-rated corporate bonds, but still maintaining Investment-Grade status. However, BBB corporate bonds come with an elevated risk of downgrade, especially during economic downturns. That’s where diversification becomes a powerful tool. Investing in BBB-rated corporate bond funds offers a balance between the higher yields of lower-rated bonds and the relative security of Investment-Grade instruments. Several funds in the U.S. market cater specifically to this segment, providing investors with diversified exposure to BBB-rated corporate bonds.

In the world of fixed-income investing, BBB-rated bonds, the lowest rated of the Investment-Grade category sitting just above High-Yield corporate bonds, hold a unique appeal, straddling the line between relative safety and higher yields. The appeal of BBB-rated bonds lies in their risk-reward profile as they typically offer higher coupon payments than higher-rated Investment-Grade counterparts to compensate investors for increased credit risk. BBB-rated corporate bond portfolios are well-suited for moderately risk-tolerant income-oriented investors seeking better yields than higher-rated corporate or government bonds.

Despite being Investment-Grade, BBB corporate bonds are not without risk as a downgrade to “junk” status can lead to sharp price declines, forced selling by institutional investors, and reduced market liquidity. This downgrade from Investment-Grade to High-Yield status is referred to as “Fallen Angel” in the corporate credit market.

This article extends our previous work on portfolio diversification of High-Yield corporate bonds to Investment-Grade corporate bonds. We will address the issue of BBB-rated portfolio diversification to reduce the impact of any single downgrade relying on several alternative diversification techniques discussed in our previous work on High-Yield corporate bonds portfolio construction. The mathematical techniques of these approaches are described in our previous work on “Alternative Diversification Investment Strategies for a High-Yield Corporate Bond Portfolio” and will be summarized below.

These alternative approaches to corporate bond portfolio construction we will be applying to BBB-rated corporate bond portfolios are:

· Equally-Weighted

· Maximum Diversification Ratio (DR)

· RMVE (Entropy-Mean Variance)

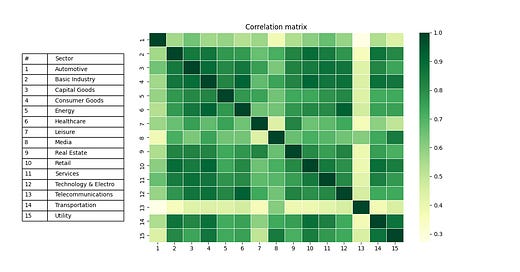

In this article, we first briefly describe these three portfolio construction techniques. We next discuss the types and variables of corporate bond data collected. Then we will describe how these diversification-based investment strategies are implemented with real BBB-rated corporate bond data spanning the full US Investment-Grade corporate bond universe over an extended time period from 1997 to 2021. We will then show their performance in terms of cumulative P&L, returns, volatilities, and Sharpe ratios over this time period, and discuss the most performing investment strategy among them. Finally, we will compare their performance versus a US BBB Corporate Bond Benchmark index.

(See link above for the complete article.)

In conclusion, we analyzed three different portfolio constructions of BBB-rated corporate bonds using systematic criteria, namely: equal-risk, maximum diversification, mean-variance entropy. All three approaches beat the Bloomberg Barclays US Corporates BBB ex-Financials benchmark over the selected period. We also found that, overall, the mean-variance entropy portfolio has superior performance relative to the other methods. This is not entirely surprising, given that the mean-variance entropy method makes a compromise between allocating to bonds that perform well and having a diversified portfolio what avoids concentrated positions.

Quantitatively Yours,