Bitcoin can be traded using different approaches. Two quite popular ways are: spot BTCUSDT (BTC against tether USDT) and using the perpetual future on BTCUSDT. Normally, futures that settle at some point ahead have a built-in stabilizing feature, namely the spot/future price convergence at expiry. For a perpetual future, there is no such thing, which is the reason why a funding mechanism has been devised. (In what follows, I describe how funding works on Binance1.)

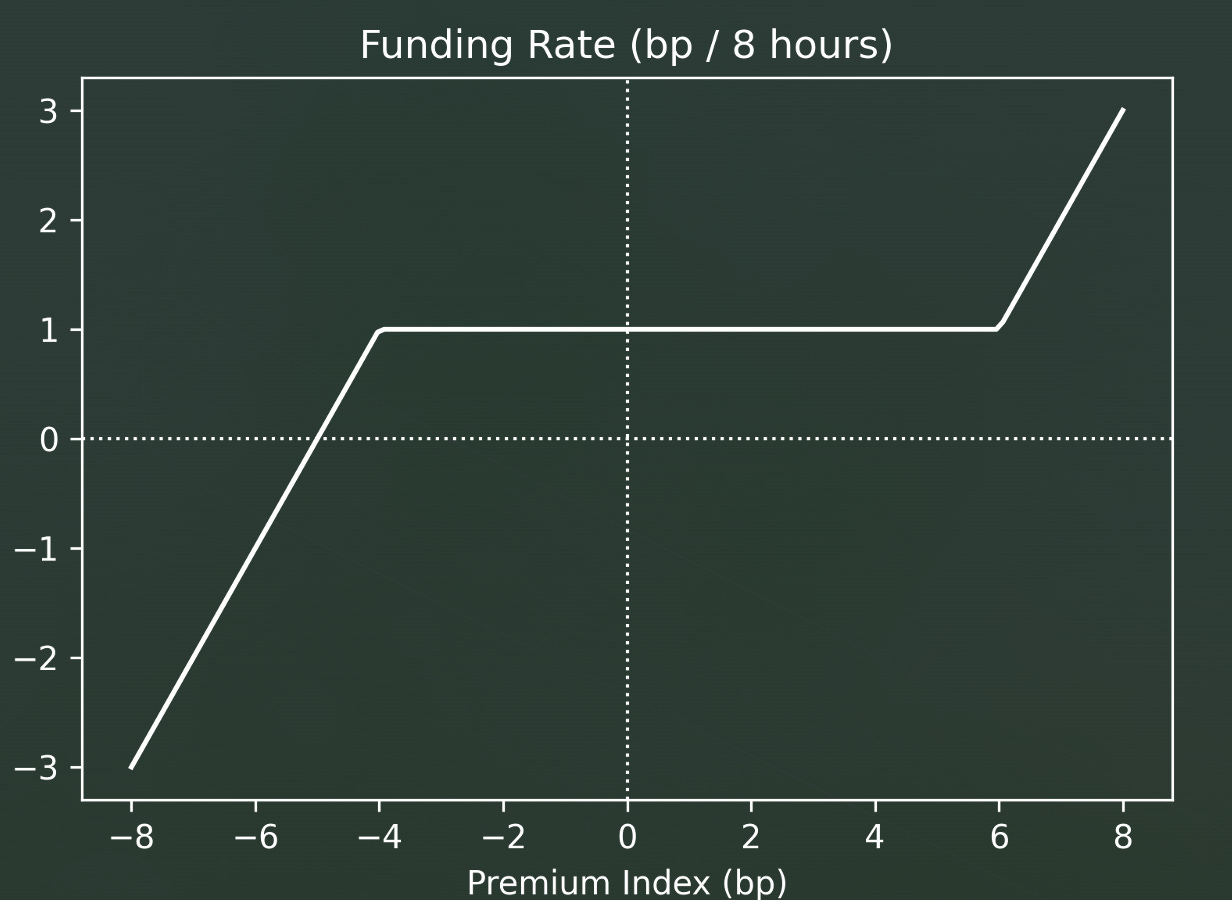

Clearly, we want to incentivize shorts in futures when future > spot (funding rate > 0, longs pay shorts) and longs when future < spot (funding rate < 0, shorts pay longs). Furthermore, we want a neutral area when future - spot is small, and a positive tilt (since the market has a long bias, therefore we need to incentivize shorts on average).

To do this, we follow the procedure:

Spot Index S = liquidity-weighted average of spot across platforms

Premium Index P (deviation future wrt spot)

P = ( max(ImpactBid – S,0) – max(S – ImpactAsk,0) ) / S

Impact Bid/Ask = future’s mkt sell/buy fill price for standard size

Funding Rate = Average P + max(min(1bp – P,5bp),-5bp)

(P is computed every 5 seconds)

Average P = linearly-weighted time average over 8 hours

Funding rate updated 00:00, 08:00, 16:00 UTC and applied to observed position at these times with cap/floor at +/- 0.75 * Maintenance Margin Ratio

This corresponds to a neutral zone with positive bias:

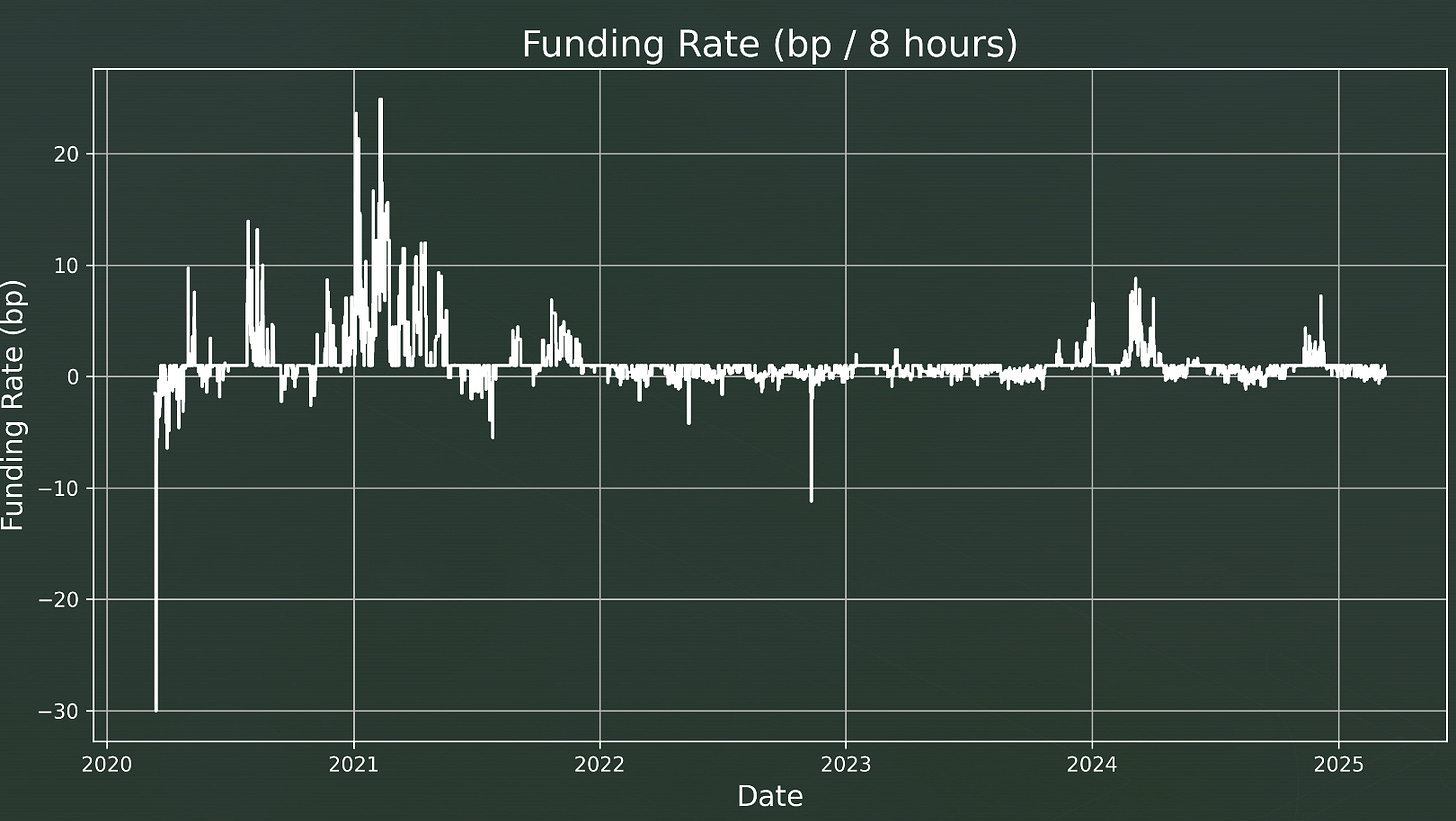

Let’s now observe the time series of observed funding rates during the past 5 years:

We note the tendency of the funding rate to be ‘stuck’ at 1 bp / 8 hours, as per methodology above.

Quantitatively Yours,

See documentation at https://www.binance.com/en/support/faq/detail/360033525031